There are two kinds of inflation, cost-push and demand-pull. All you self employed people know what cost-push inflation is. As your cost of doing business (labor, materials, supplies, utilities, etc.) increases, to the extent you can, you pass those increases along to your customers little by little. These are the same costs your competitors are experiencing as are others in other industries. The result is a rise in the general level of all prices to the consumer.

Demand-pull inflation, on the other hand, occurs when the demand for particular products and/or services exceeds the supply. You know what happens then. The price tends to get bid up. For example, are any of you Barbie doll collectors? My granddaughters are. Some of you probably are too and I bet you look on ebay for bargains. What if we all became collectors and went to ebay to look for bargains and there was only one doll currently being listed and it was really collectible? The price would get bid up (the dream of every ebay seller). On a larger scale, this can happen in an industry and so much so that it would affect the CPI. Gasoline is an example. Do any of you remember back in the late 1970s. Lines at the gas pumps. Prices rising. When this happens, the politicians are quick to call for price controls but that only encourages the development of a black market.

In any event, you see how these situations can arise. We normally think of inflation as a bad thing because it erodes the purchasing power of God’s money. For example, let’s say that God provided us with an income of $30,000 in the year 2000 and this was sufficient to meet all our NEEDS. Given the rate of inflation we have experienced since then, in order to purchase those same NEEDS in 2006, would take $35,121.95. You begin to see the problem. We all feel it. The cans of green beans get a little smaller and the price goes up a penny or two. Pop machines have had bill acceptors on them for quite a while now. If God does not provide an increase to meet these needs, WHAT DO WE DO?? How do we deal with it? There are three things we can do; what do you think they are?

- __________________________________________________________

- __________________________________________________________

- __________________________________________________________

On the other hand, inflation is not all bad. What if we borrowed $30,000 (with a collateralized loan at the bank of course and not on all our credit cards) in 2000 and got it paid back in 2006. Because of inflation, the purchasing power of the $30,000 will have eroded to $22,770.03. The bank of course is aware of this phenomenon and you have probably noticed that the interest rates they charge for loans always seem to be higher than the rate of inflation.

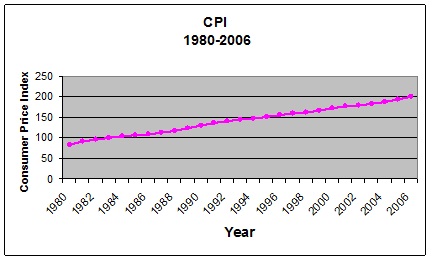

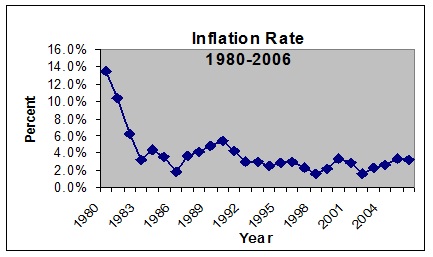

I know you are really interested in this so take a look at the chart shown below. You will notice that the CPI is increasing ever so slightly each year but not quite in a straight line. The inflation rate shown in the second chart shows how much and in what direction the CPI is changing each year. Notice that the changes are always positive (at least during this period of time).