To Borrow or Not To Borrow, that is the (steward’s) Question!

But what about all the financial baggage I’m carrying around? I have more than three credit cards. I’m carrying a balance on my (more than three) credit cards. I bounced a bunch of checks and the bank closed my checking account. I’m a month behind on my rent. I was turned down recently for another credit card because my credit score was so low. Etc. Etc. Etc. What do I do now?

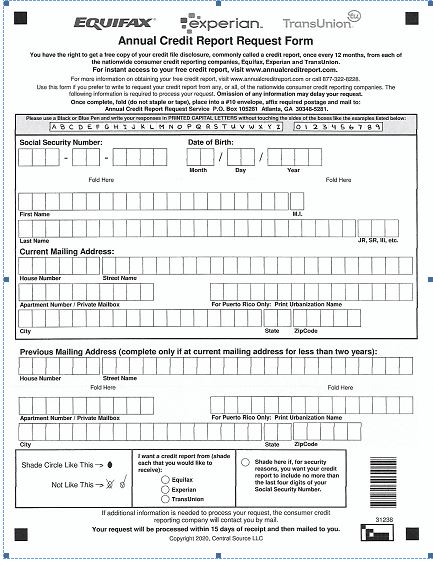

Not to worry. Your financial circumstances just need a little repair. You can find out just exactly what your financial situation is by getting a copy of your credit reports and they’re free. The first thing to do is order a copy of your credit reports at annualcreditreport.com. Ordinarily I would suggest spacing these requests out so that you get one every four months but since you are just starting out on the repair journey it would be good to see all three of the reports to begin with. A relatively new law allows you to obtain one free credit report from each of the three credit reporting companies (Equifax, Experian, and TransUnion) every year. You may have heard or seen an advertisement from “FreeCreditReport.com” or similar. DON’T GO THERE! It’s probably not free. You must go directly to the credit reporting company or to annualcreditreport.com to get your free copy. If you don’t have a computer that is hooked up to the internet you can call 1-877-322-8228. Although the reports are free, they probably won’t tell you what your credit score is for free. They may offer to sell you the score for a nominal fee, somewhere around $10 each. (An exception to this currently is Discover. My Discover bill every month shows me my current FICO score, which I appreciate.) You should probably buy your score to see exactly where you are starting from. Your credit reports will show/tell you what needs to be fixed.

What if I find errors on my report? Again, not to worry. You can challenge any of the information you find on your reports and ask that it be corrected or removed. A “dispute” form will probably be included with your report and it will have instructions on how to use it. Some of the credit reporting companies permit disputes to be made on line. In any event, the reporting company has 30 days to investigate your claim and report the results to you. Inaccurate information must be corrected or removed. Out of date information must be removed. If the information in question cannot be verified by the credit reporting company, it must be removed. If an item of information remains in dispute after investigation, you may add a statement to the file explaining your side of the story. Nobody will probably read it but it will make you feel better.

This first step in the repair shop is very important. It will be time consuming. It will try your patience. It will be frustrating. However, 25% of all credit reports have errors serious enough to cause denial of credit. This is important to us Christian stewards because we want the credit to be available with the best terms even if we aren’t going to use it.

Now, stop charging stuff on your credit cards or store accounts or anything else. Then go to your cash flow statement (budget) and find some items labeled with a “W” (Remember what we said “W” stands for? It stands for “wants.”) and quit spending money on those items. Redirect that money to your credit card balance with the highest rate of interest until it is paid off. Some experts would say to direct it to the card with the smallest balance so you will experience the emotional high from paying it off sooner. It doesn’t really matter which route you take, just start doing it. As each balance is paid off redirect the payments to the next balance. You’ve heard of the snowball effect. It works really well in this situation. Some creditors may be willing to help you in this endeavor by lowering interest rates, removing late fees or over-limit fees, removing annual service fees, changing due dates and reducing minimum payments. It’s worth a call to explain your situation and ask for their help. Be persistent in your calling and ask for a supervisor if you must to get a “hearing”. Be sure to make a note of all the calls and who you talk to. Keep copies of any correspondence with creditors. When you finally get all the balances paid off, start following the four rules for successful use of credit. Depending on how big your balances are it may take quite a while to get to this point. Hang in there. It’s worth the trip both from an emotional point of view as well as a wise business practice point of view. And I guarantee you will experience the joy of the Lord and bring Him glory and isn’t that what He wants? As a word of encouragement, I have a friend who has been through this process twice. Starting at more than $150,000 balance on more than 40 credit cards, he has succeeded in paying them off twice. You can do it too.

Now about that checking account the bank or credit union has closed. If you fix the problem that caused your account to be closed, they might let you open a new account (but they don’t have to). At a minimum you will have to make good on the checks you bounced, late fees, over limit fees, etc. They will want to see your credit report(s). They will want to see your credit score. They may want to see some other personal financial information. In short, they want some assurance that the same thing isn’t going to happen again. You will probably be able to find a bank/credit union that will allow you to open a new account.

To summarize what we have learned in these last several weeks:

- The Bible and all the authors and experts I have read don’t have much positive to say about borrowing but they don’t forbid it either.

- There seems to be only two Biblical rules: a) pay it back and b) don’t co-sign.

- In my opinion, as God’s stewards/managers there’s only one possible reason we might want to borrow some money and that’s for shelter.

- To live successfully IN the “real” world today and not become part OF it requires that we establish and maintain good credit but don’t use it (easier said than done for many if not most of us).

Use the form below to obtain copies of your credit reports……….

=====================================================================